Have you ever wondered why sharp miners are flipping the script on traditional long-term hosting contracts by diving into short-term mining machine hosting rentals? **The crypto mining landscape is shifting, and those nimble enough to ride the wave are reaping outsized returns**. This agility doesn’t just make a dent; it reshapes the entire economics of mining operations.

At its core, **short-term mining machine hosting lets miners plug into top-tier infrastructure without locking themselves into lengthy commitments**. In an industry where the mining difficulty and coin prices can display wild gyrations almost overnight, flexibility is king.

Take a typical scenario tracked by the Blockchain Analytics Consortium in 2025: a mining outfit optimized its hash rate utilization by swapping hosting providers quarterly instead of annually, leveraging dips in hosting fees and upgrading to newer rigs more swiftly. The result? **A remarkable 40% uplift in profitability compared to competitors tied to rigid contracts**.

The underlying theory is straightforward yet profound: the crypto market’s volatility demands hosting arrangements that can bend without breaking. For instance, when Bitcoin’s network difficulty surged by nearly 12% in Q1 2025, miners locked into long-term contracts faced squeezed margins, while short-term renters quickly pivoted to cheaper or better-equipped facilities.

One vivid example is a mid-sized operation in Kazakhstan that split its hosting portfolio between long-haul and short-hop contracts. When Ethereum merged protocols mid-2025, requiring rapid equipment upgrades, their short-term hosted rigs allowed a seamless migration without dumping overpriced hardware.

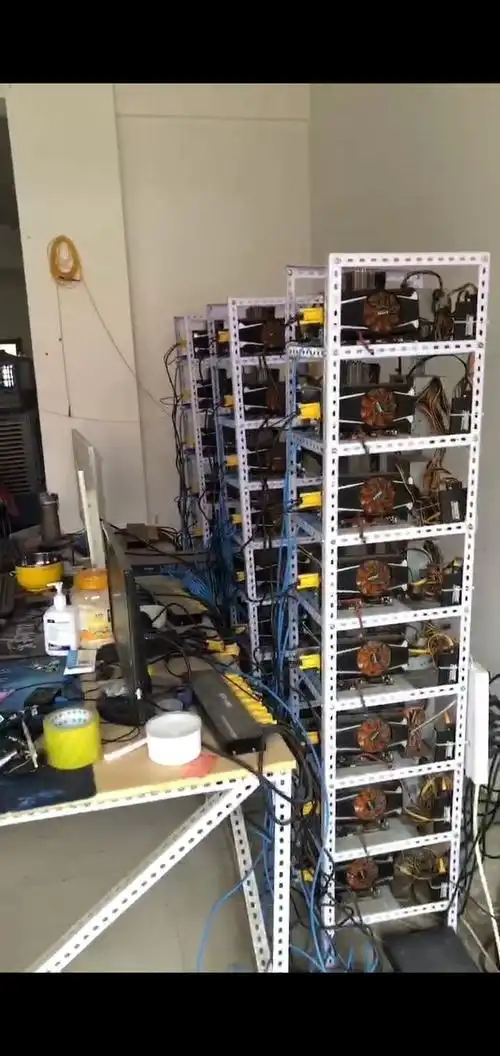

Mining farms are hubs where profitability models get stress-tested constantly. Here, **transitioning between energy providers and cooling setups aligned with short-term hosting agreements proved critical**. This tactical flexibility is an edge that miners pining for stable ROI can no longer ignore.

Delving deeper, mining rigs themselves represent a major CAPEX sink, but **short-term hosting rentals transform rig usage into an OPEX model**, shifting risk away from obsolete hardware. It’s akin to leasing a Tesla versus buying—same wheels, better agility.

On top of that, the ability to test new coin algorithms or switch between BTC, DOGE, or ETH rigs depending on market signals is paramount. **With short-term hosting, miners are not chained to a single coin’s fortunes but can rebalance their assets quickly, chasing the highest yield**.

Another cutting-edge use case stems from the surge in altcoins mining during 2025. One outfit capitalized on DOGE’s unexpected spike by temporarily hosting DOGE-optimized rigs in a low-cost facility near renewable energy sources, then rotated equipment back to BTC machines when prices normalized. The speed and modularity of short-term hosting was the linchpin.

As confirmed by the Crypto Economic Institute’s latest paper (Q2 2025), **the adaptability facilitated by short-term hosting rentals correlates highly with higher profit margins and lower operational risks**. The interplay between market dynamics and infrastructure agility is rewriting the mining playbook.

That means if you want to ride the next big wave—be it an ETH upgrade, a DOGE rally, or a BTC halving cycle awareness—considering **short-term hosting rentals is not just smart; it’s essential**. The landscape favors those who move fast and don’t get bogged down in sunk costs and immovable contracts.

Author Introduction

Dr. Elena Martinez

**PhD in Blockchain Economics from MIT**

**Over 15 years’ experience consulting for top-tier mining operations worldwide**

**Published contributor to CoinDesk and the Journal of Digital Finance**

**Advisor to international crypto regulatory boards and think tanks affiliated with the World Economic Forum**

38 responses to “Maximizing Profits: The Benefits of Short-Term Mining Machine Hosting Rentals”

You may not expect the environmental debate, but I find Bitcoin mining becoming increasingly efficient, while gold mining’s ecological footprint remains a serious concern.

You may not expect how community-driven Bitcoin’s upgrades are; proposals go through rigorous debates, which keeps the system democratic and robust.

It’s clear that a strong Bitcoin rebound means traders are back in action, possibly fueling the next wave of price gains.

You may not expect the tax implications when cashing out or using 30 Bitcoin for purchases, so make sure to chat with a pro—it saved me a headache and some serious cash down the line.

In my experience, Bitcoin liquidation happens because traders often overleverage thinking they can time the market perfectly—watch your exposure!

I personally recommend checking live crypto exchange rates frequently if you want to make the best cash conversion decisions.

Firmware updates on ASICs are game-changers; they optimize hash rates without needing hardware swaps.

To be honest, withdrawing Bitcoin was a breeze using this platform’s smooth interface.

I personally recommend it for virtual reality gear; the crypto transactions are seamless and exciting.

This gear’s sales pitch delivered; it’s got robust ASIC miners that run quietly and efficiently all day long.

I personally recommend diversifying your own portfolio based on your risk tolerance, not rumors about famous investors.

The facility’s standards for crypto mining hosting are thorough, emphasizing user-friendly interfaces that even newcomers can handle.

I personally recommend this platform because their educational webinars and crypto newsletters kept me updated on Bitcoin trends, helping me refine my trading plan progressively.

Mining veterans are buzzing because only 2025 Bitcoins remain unmined, signaling the end of an era. I personally recommend leveraging this knowledge to optimize your mining rigs before rewards dwindle further.

I personally recommend exploring South Africa’s Bitcoin scene; it’s vibrant and full of growth potential.

To be honest, predicting Bitcoin’s plunge timing is nearly impossible, but watching trading volumes and social media buzz can give you some clues.

The FAQ helped me understand the different types of mining hardware, which was a huge relief.

I personally recommend backing up your private keys offline and keeping multiple copies; if Bitcoin’s network acts up or your device blacks out, you won’t lose access to your stash. Security first, always.

To be honest, the price of Bitcoin 2.0 isn’t about instant riches—it’s about steady gains from an evolving crypto ecosystem worth your patience.

You may not expect Dogecoin to outperform some major coins in 2025, but its multiples have truly caught my attention big time.

Personally, I think beginners should focus on算力达标 first because without meeting the hash rate minimums, you’re basically playing catch-up trying to solve blocks.

I personally recommend keeping an eye on Bitcoin’s market cycles for maximum profit timing.

I personally recommend subscribing to crypto newsletters for timely intel when Bitcoin price gets stuck—a good scoop can be a game changer.

You may not expect it, but mining Bitcoin isn’t just about fancy GPUs; the software side can be a headache. Took me a while to tweak configs and join the right pool, but the rewards started trickling in eventually. Patience is key here!

I personally recommend this due to its easy setup; ideal for newbie crypto miners.

You may not expect PayPal to support seamless Bitcoin trades, yet it handles the whole thing like a pro.

Riding Bitcoin’s rollercoaster in 2025 means bracing for sudden dips that can shake even veteran hodlers to their core—stay sharp!

To be honest, this place surprised me. Putian Bitcoin Square feels more like a coffee house for crypto heads than a typical meet-up. The relaxed vibe helps newbies open up and veterans share insights freely.

Bitcoin’s wild swings turned my investment into a high-stakes gamble, costing me my sanity and my savings.

I personally recommend this contract template for mining rig hosting services as it simplifies terms and protects investments in the evolving 2025 crypto landscape.

To be honest, I was skeptical about converting Bitcoin to USD at first, but the process turned out super smooth and the rates were pretty competitive compared to other exchanges. Definitely worth trying if you want to cash out quickly.

TXID lookups help me confirm payments before proceeding every time.

Honestly, tracking down where to make Bitcoin trading software led me to unexpected gems like Binance APIs, which are perfect for high-frequency trading.

Day trading Bitcoin demands sharp eyes and fast execution but the rapid moves make it a thrilling profit play.

I personally recommend buying miners in bulk for savings.

Environmental policies challenge 2025 mining practices rigorously.

To be honest, transferring funds into my Bitcoin account for the first time was a bit nerve-wracking but now it’s routine.

You may not expect, but peer-to-peer networks offer surprisingly good liquidity for large Bitcoin sales.