The mining machine market is undergoing a remarkable transformation as we venture into 2025. Amidst the dynamic landscape of cryptocurrencies, the demand for efficient and innovative mining rigs is surging. To truly grasp what sellers and buyers should prepare for, we must first understand the trifecta of technological advancements, ecological considerations, and market volatility.

As Bitcoin (BTC) continues to dominate the crypto sphere, the spotlight remains on mining machines capable of harnessing its substantial computational power. Yet, it’s not just BTC that is gaining traction. Ethereum (ETH) maintains a robust presence, with its transition to proof-of-stake prompting a need for versatile mining solutions. In 2025, one can expect a sophisticated range of mining machines designed for multi-currency capabilities, catering not only to BTC and ETH but also to the growing popularity of altcoins like Dogecoin (DOG) and others.

The market for mining machines is intensifying, fueled by factors such as user demands for higher efficiency and sustainability. With environmental concerns at an all-time high, the spotlight shines on energy-efficient models. Sellers must adapt their offerings to include eco-friendly machines that satisfy regulatory requirements while providing value for money. For buyers, this represents an opportunity to invest in technology that not only promises profitability but also aligns with global sustainability efforts.

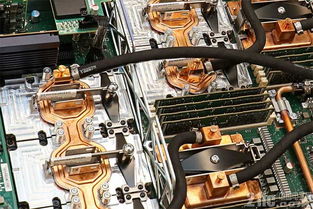

Furthermore, as more players enter the crypto market, the landscape of mining machine hosting is evolving. Instead of individuals running operations from home, a shift to professional mining farms is becoming prevalent. These facilities provide miners with the advantageous infrastructure they need—optimized cooling, advanced maintenance, and unfettered access to high-end equipment. Understanding this trend is crucial for both buyers, who may consider hosting solutions for a hands-off experience, and sellers who must align their products with this burgeoning sector.

With the rise of mining farms and co-location services, sellers should consider offering bundled services or packages. This could be in the form of lease agreements or managed hosting plans that promise not just hardware but a hassle-free mining experience. Buyers, on the other hand, should prepare to evaluate the total cost of investment—factoring in electricity, cooling, and potential downtime. The focus should shift to long-term profitability rather than mere upfront costs.

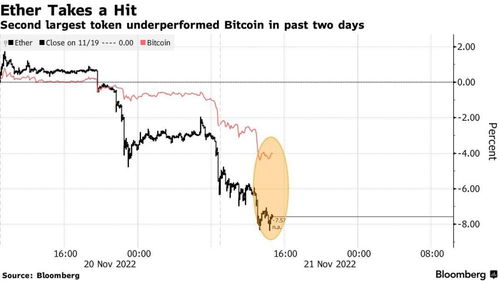

Market volatility also plays a pivotal role in shaping the mining machine landscape. The rise and fall of Bitcoin prices can have immediate ramifications for mining profitability. Sellers need to keep abreast of market trends, anticipating shifts in demand based on price fluctuations. For buyers, understanding market sentiment is key—in this climate, timing their investments can yield better returns and enhance ROI.

Additionally, as the cryptocurrency market evolves, regulatory frameworks are becoming more defined. Countries are adopting various stances on cryptocurrency mining, affecting the mining hardware procurement process. Sellers should be prepared to navigate these regulations and communicate compliance clearly to potential buyers. Furthermore, buyers should conduct thorough research to identify jurisdictions that align with their mining activities and objectives, which influences their purchasing decisions and potential returns.

Meanwhile, the race for innovation continues. From ASIC miners to GPU setups, advancements are constantly changing the game. Sellers need to stay ahead of the curve, investing in R&D to deliver high-performance mining rigs that operate efficiently and reduce power consumption. Buyers must remain vigilant, comparing machine specifications and understanding how these innovations affect their profitability margins.

The crypto community holds a collective aspiration for a decentralized future, and with it, the need for resilience and adaptability in mining practices. The next market phase will likely require concerted efforts in improving technology, embracing sustainable practices, and navigating market fluctuations. Both sellers and buyers must prepare for a landscape shaped by technological progress, market trends, and an increasing focus on environmental responsibility.

In summary, as we look forward to 2025, the mining machine market teeters on a precipice of transformation. It is essential for buyers to conduct diligent research and prepare strategically for emerging opportunities. Simultaneously, sellers must innovate and adapt their offerings to stay relevant in a volatile environment. The synergy between these two players will ultimately shape the next chapter in the world of cryptocurrency mining.

One response to “2025 Mining Machine Market Forecast: What Sellers and Buyers Should Prepare For”

In the chaotic dance of tech and resources, this forecast unveils 2025’s mining machine saga, urging sellers to wield innovation like weapons and buyers to brace for volatile twists in demand and regulations.