The relentless hum of mining rigs, a symphony of silicon churning through algorithms, is the soundtrack of the digital gold rush. But behind the scenes, a far less glamorous, yet equally critical, aspect of cryptocurrency mining unfolds: financing. Enhancing your mining profitability isn’t solely about optimizing hash rates and minimizing electricity costs; it’s also about strategically leveraging financial tools to navigate the volatile crypto landscape and maximize your return on investment. This means understanding everything from the nuances of Bitcoin halvings to the surging popularity of meme coins like Dogecoin, and how these factors impact your bottom line.

The initial outlay for mining equipment, particularly specialized ASICs (Application-Specific Integrated Circuits) geared towards Bitcoin mining, can be substantial. These powerful machines, the workhorses of the crypto mining world, aren’t cheap. Securing adequate funding to acquire them is the first hurdle. Traditional financing options, such as bank loans, are often difficult to obtain due to the perceived risk associated with the cryptocurrency industry. This leaves many miners exploring alternative funding routes like venture capital, angel investors, or even crowdfunding initiatives. Each path comes with its own set of considerations and potential drawbacks, demanding careful evaluation.

Beyond the initial investment, operational expenses, primarily electricity, represent a significant ongoing cost. Mining profitability is inextricably linked to energy prices, creating a constant pressure to find cheaper sources of power. Hosting mining rigs in regions with low electricity costs, often referred to as mining farms, has become a popular strategy. These large-scale operations benefit from economies of scale, negotiating favorable electricity rates and optimizing infrastructure for cooling and maintenance. However, even with lower electricity costs, operational expenses can fluctuate due to unforeseen circumstances, requiring flexible financial planning.

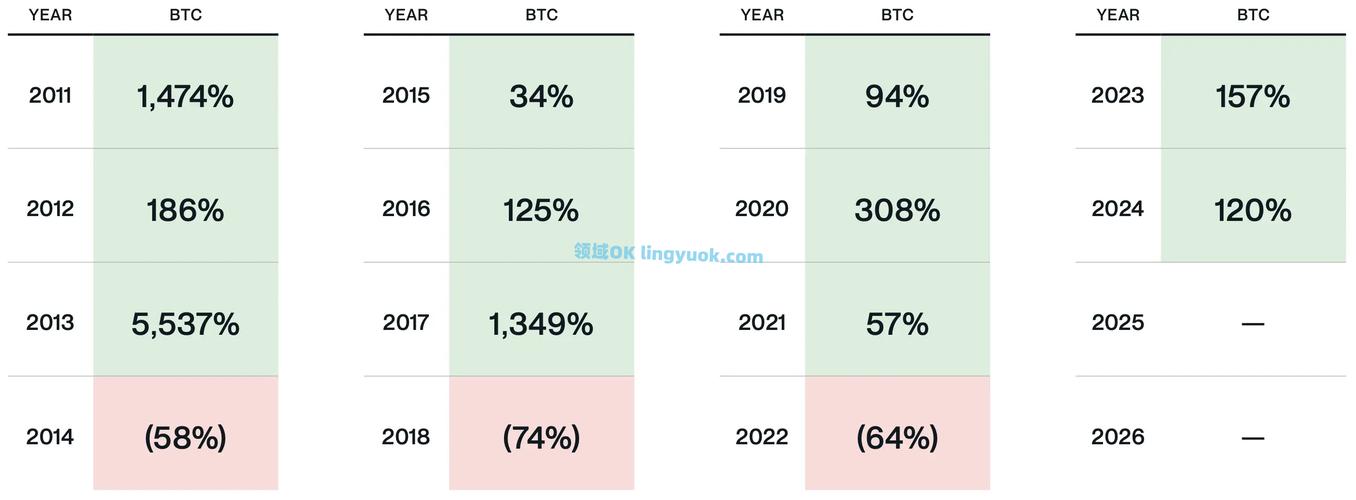

Cryptocurrency mining, especially Bitcoin mining, is a highly competitive landscape. The difficulty of mining increases as more miners join the network, meaning that more computational power is required to solve the same number of blocks and earn rewards. This constant arms race necessitates continuous investment in newer, more efficient mining rigs to stay competitive. Furthermore, the Bitcoin halving events, which occur roughly every four years and reduce the block reward by half, significantly impact mining profitability. Miners need to anticipate these events and adjust their financial strategies accordingly to maintain a sustainable operation.

Another critical aspect of enhancing mining profitability is risk management. The cryptocurrency market is notoriously volatile, and the value of mined coins can fluctuate dramatically. Hedging strategies, such as futures contracts or options, can be employed to mitigate the risk of price declines. Diversifying into mining other cryptocurrencies, such as Ethereum (ETH) (although the shift to Proof-of-Stake has altered the landscape for ETH mining) or even exploring the potential of mining coins like Dogecoin (DOGE) during periods of high trading volume, can also help to reduce overall risk. However, each cryptocurrency has its own unique set of challenges and opportunities, requiring careful research and analysis.

The world of DeFi (Decentralized Finance) offers innovative financing opportunities for miners. Platforms like MakerDAO or Aave allow miners to borrow against their crypto assets, providing access to capital without having to sell their holdings. This can be particularly useful for covering operational expenses or upgrading mining equipment. However, DeFi platforms also come with their own set of risks, including smart contract vulnerabilities and impermanent loss, requiring a thorough understanding of the underlying mechanisms.

Exchanges play a crucial role in the mining ecosystem. Miners typically sell their mined coins on exchanges to cover expenses and generate profits. Choosing the right exchange is essential to minimize transaction fees and maximize returns. Factors to consider include liquidity, security, and the availability of trading pairs for the specific cryptocurrencies being mined. Furthermore, understanding the tax implications of cryptocurrency mining and working with a qualified tax advisor is crucial for ensuring compliance and optimizing tax strategies.

Strategic financing for cryptocurrency mining is an ongoing process that requires constant adaptation to the ever-changing market conditions. It’s about understanding the interplay between hardware, software, energy costs, market volatility, and financial instruments. By carefully planning and executing a well-thought-out financial strategy, miners can significantly enhance their profitability and navigate the complexities of the digital gold rush.

In conclusion, the path to enhanced mining profitability extends far beyond simply acquiring the most powerful mining rig or finding the cheapest electricity. It demands a sophisticated understanding of financial principles, a proactive approach to risk management, and a willingness to explore innovative financing solutions. The successful miner of today is not just a technologist; they are also a savvy financial strategist, constantly adapting to the dynamic and unpredictable world of cryptocurrency.

One response to “18. Enhancing Your Mining Profitability Through Strategic Financing”

This article cleverly unmasks financing as the secret pickaxe for miners, blending loans, investments, and risk hedging to unearth profits. Fresh insights make it a thrilling read, though real-world volatility adds spice—highly recommended for bold diggers!